With the AL REEM platform , SMEs can apply for small business loans

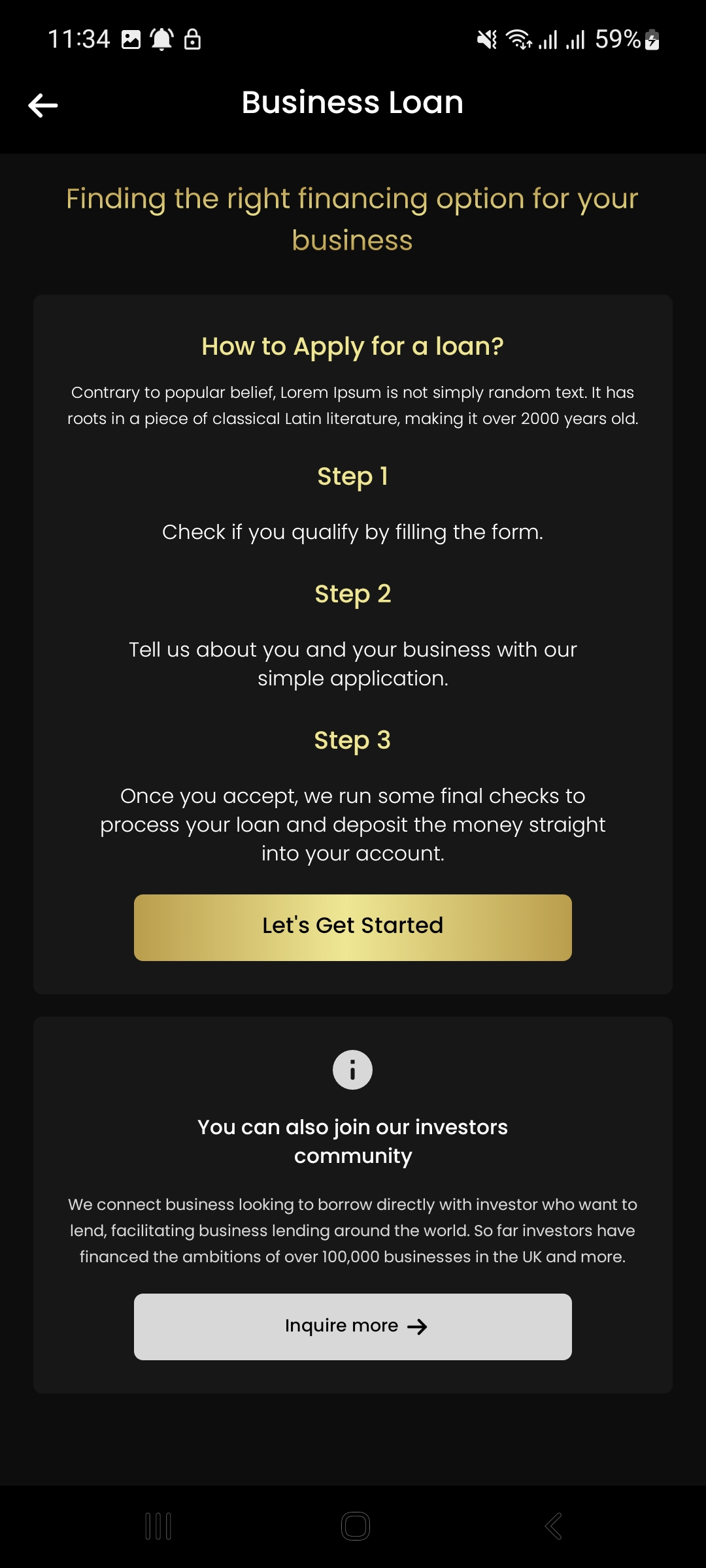

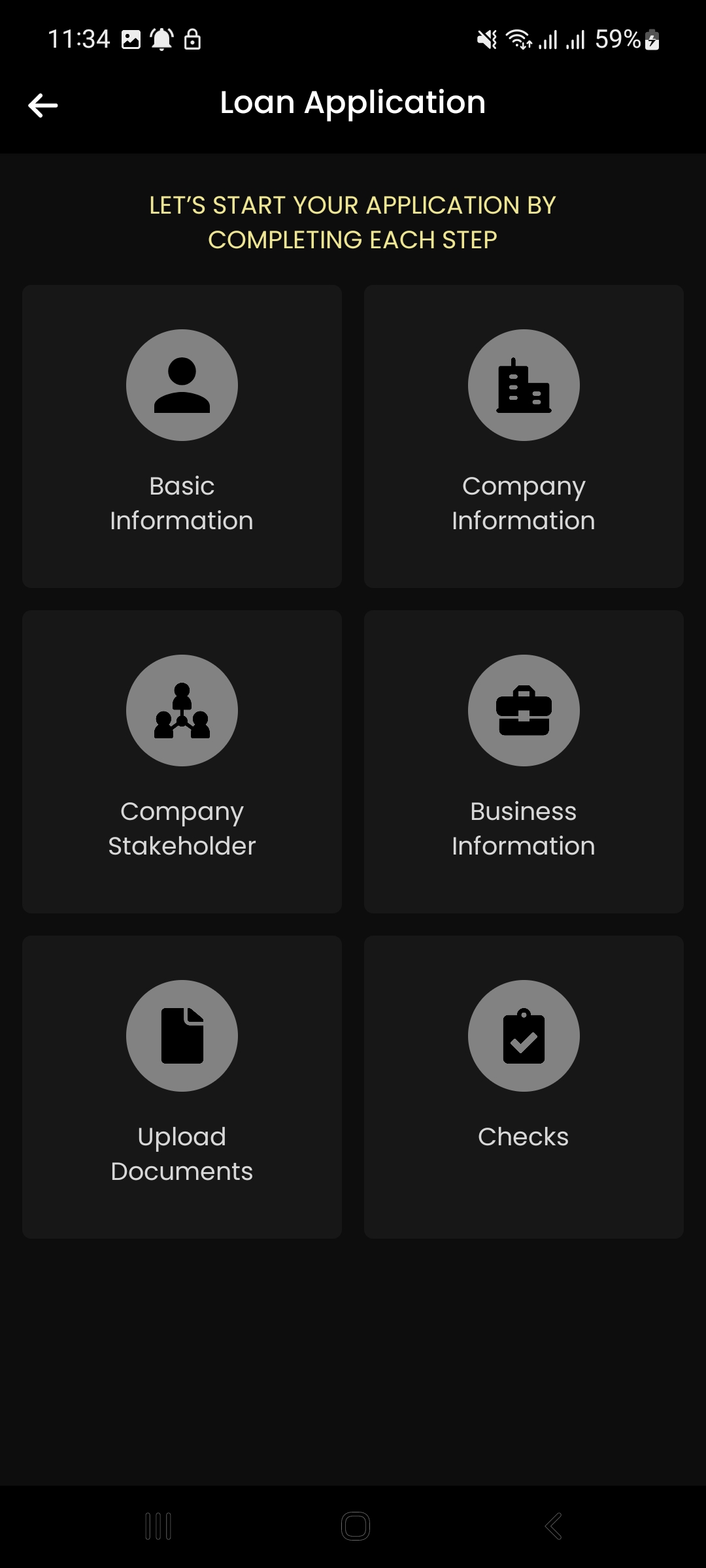

Applicants will be prompted through a series of questions in which they answer how much they need to borrow, choose the loan terms, and fill out questions related to their business operations and explain the use of the funds. Documents will be needed for verification and loans receive instant approval followed by an approximately 1-hour verification process.

SMEs will have the ability to be matched with the right investors from fund houses, banks, and individual investors. This will help match lenders with SMEs looking for funding whilst facilitating a strong community of businesses.

The Al REEM platform with its rich data and proprietary scoring models will help make the lending decisions fast and effective.